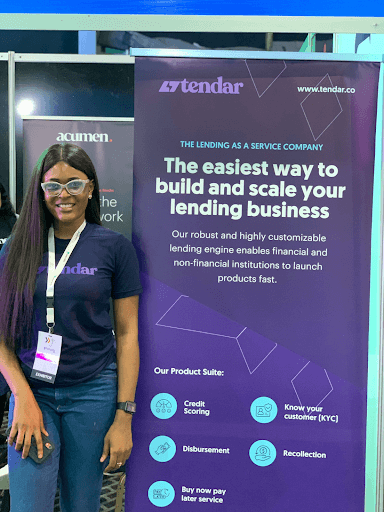

In a transformative leap for Africa’s financial sector, Tendar is setting a new standard with its Lending as a Service Solution. Founded by Ayo Onasanya and backed by a dynamic team of industry experts, Tendar is redefining how financial resources are accessed and managed.

Committed to democratising lending, Tendar addresses critical gaps overlooked by traditional financial institutions, offering a modern and inclusive approach to credit. By leveraging advanced AI technology and data-driven insights, Tendar provides innovative financial solutions that cater to the diverse needs of borrowers. The platform offers a range of services, including automated recovery systems, end-to-end loan management tools and a ready-to-use Buy Now, Pay Later (BNPL) solutions. Lenders have the ability to configure Tendar’s solutions to their needs and also optimise their specific loan default rates.

One of the backbones of Tendar’s platform is the credit scoring and decisioning system, which streamlines the assessment of borrower creditworthiness. Tendar’s AI analyses payment timeliness, credit utilization and bankruptcy records to predict future behaviours.

Critical to the success of any lending organisation is the effectiveness of its recovery system, protocols, and overall efficiency. Therefore, Tendar’s recollection feature automates loan recovery seamlessly. With its unique direct debit functionality, lenders can effortlessly retrieve loans, ensuring timely repayments and enhancing businesses financial stability. This customized recollection approach helps lenders manage risks, minimize losses, and maintain positive borrower relationships while ensuring compliance with regulatory requirements.

The platform has set a new standard for security and transparency in the lending industry with robust Know Your Customer (KYC) protocols using secure encryption techniques and identity verification measures to protect sensitive information, instilling confidence in lenders and borrowers.

Tendar’s low-code services have redefined the approach in lending by allowing businesses to establish their digital presence by creating their own customized lending platform in a matter of days/weeks. The platform offers pre-built lending functionalities with seamless integration, easy customization, and rapid deployment, ensuring scalability and meeting business’s ever evolving needs. This service enables swift market entry, allowing you to navigate the lending landscape with agility and efficiency.

Beyond individual lending solutions, Tendar leads the way in introducing the Buy Now, Pay Later (BNPL) model for businesses. Understanding the unique challenges businesses encounter in Africa, Tendar provides customizable financing solutions to meet their specific needs.

The automated disbursement feature on Tendar streamlines lending by eliminating lengthy approval processes and paperwork, allowing funds to be quickly and effortlessly disbursed so borrowers can achieve their financial goals.

As we look to the future, Tendar stands as a beacon of progress. Are you ready to integrate Tendar into your lending platform? Send an email to hello@tendar.co or talk to sales via tel:+2349039181976.